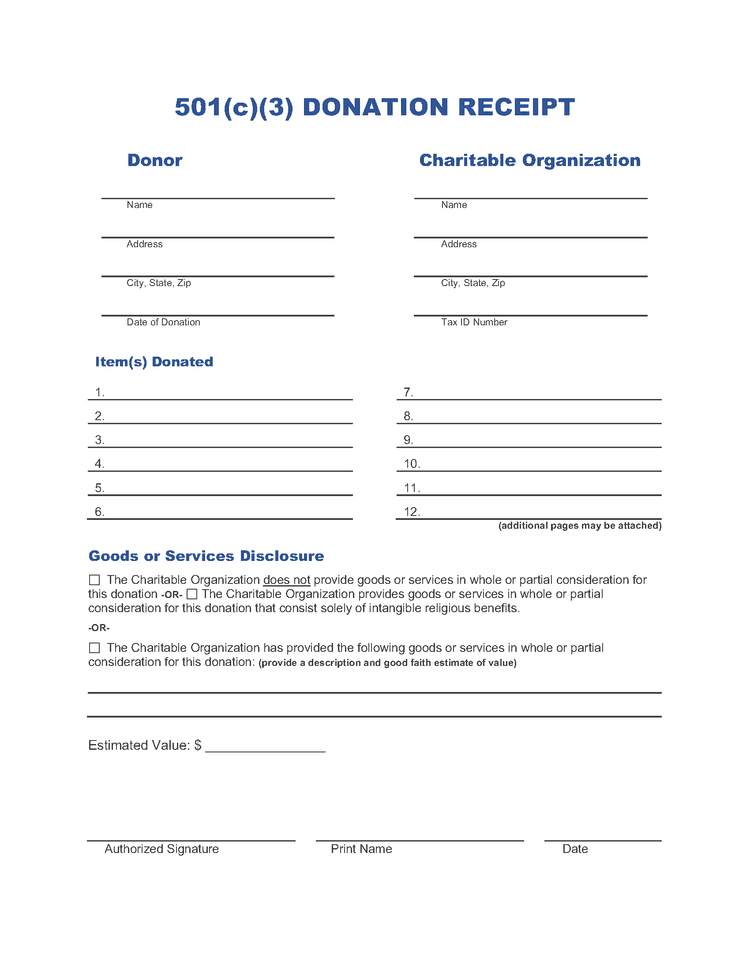

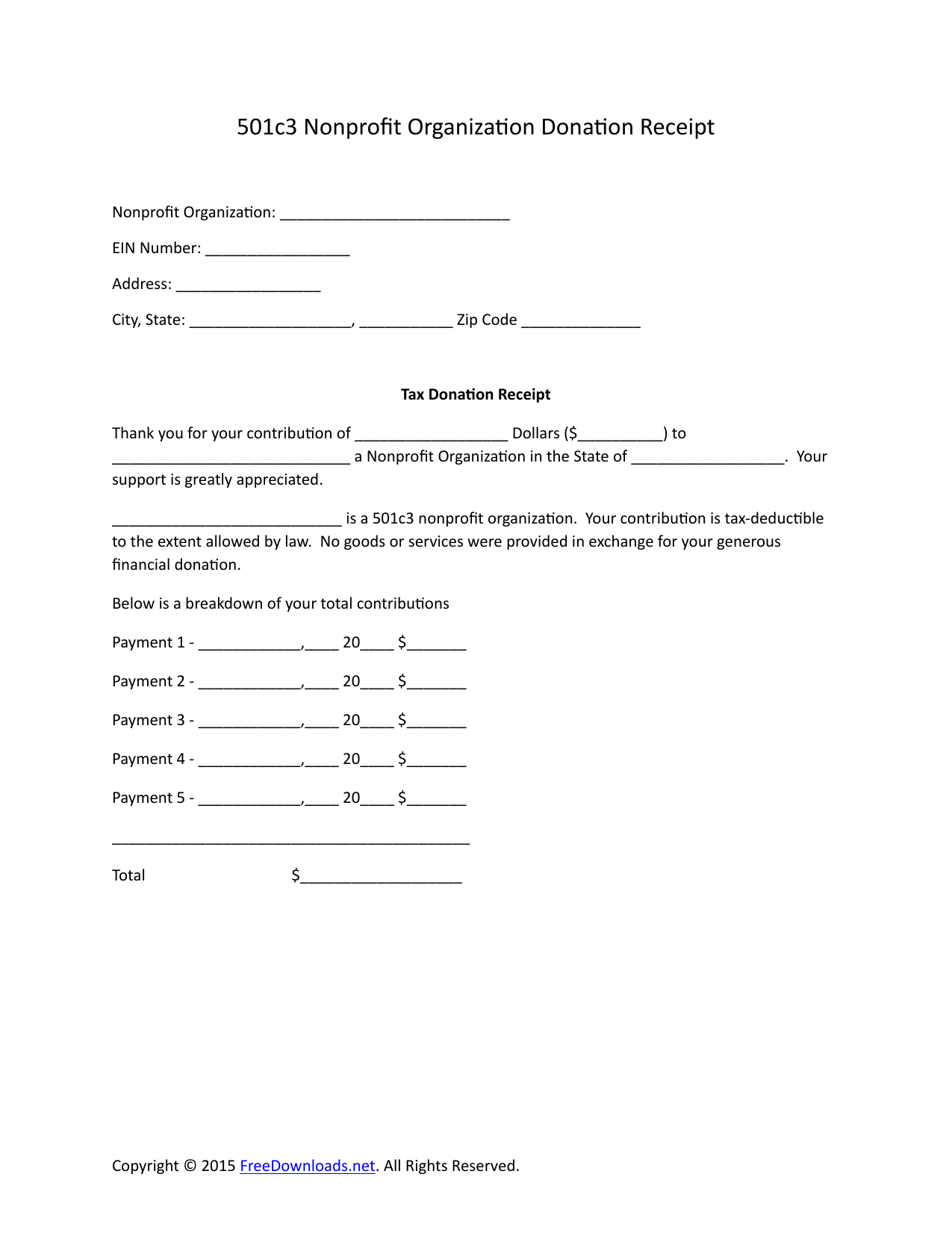

501C3 Donation Receipt Template - Made to meet us & canada requirements. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Donors and charities need to keep these receipts for bookkeeping and tax filing purposes. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. Web get a free nonprofit donation receipt template for every giving scenario.

501c3 Donation Receipt Template Printable pdf & Word pack Etsy

A donation receipt is an official document that provides evidence of donations or. Web the written acknowledgment required to substantiate a charitable contribution of $250.

501c3 Donation Receipt Template Printable Pdf Word Re vrogue.co

__________________ (find on the irs website. Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in.

501c3 Donation Receipt Template Printable [Pdf & Word]

Web a 501(c)(3) donation receipt is the written record of a gifted contribution to an eligible charitable organization. Donation receipts are quite simply the act.

free church donation receipt word pdf eforms editable free 5 church

Web 501(c)(3) organization donation receipt. A donation receipt is an official document that provides evidence of donations or. Made to meet us & canada requirements..

Printable 501c3 Donation Receipt Template Printable Templates

Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. __________________ (find on the irs.

501c3 Donation Receipt Template Printable [Pdf & Word]

Web a 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more..

Printable 501c3 Donation Receipt Template risakokodake

Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: Donation receipts are quite simply the.

501c3 donation receipt template addictionary download 501c3 donation

Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. A donation receipt is an.

501(c)(3) Organization Donation Receipts (6) Invoice Maker

Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes. Web a 501 (c) (3).

Web A 501(C)(3) Donation Receipt Is The Written Record Of A Gifted Contribution To An Eligible Charitable Organization.

A donation receipt is an official document that provides evidence of donations or. Donors and charities need to keep these receipts for bookkeeping and tax filing purposes. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes.

Donorbox Tax Receipts Are Highly Editable And Can Be Customized To Include Important Details Regarding The Donation.

Made to meet us & canada requirements. Web choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors. __________________ (find on the irs website. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information:

Web A 501 (C) (3) Donation Receipt Is Required To Be Completed By Charitable Organizations When Receiving Gifts In A Value Of $250 Or More.

Web get a free nonprofit donation receipt template for every giving scenario. Web 501(c)(3) organization donation receipt. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation.

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt.jpg)

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg)