Cost Segregation Study Template - • how cost segregation studies are prepared; Web we will show the detail on applying a cost segregation study on property owned and placed in service prior to the current tax year. • what to look for in the review and examination of these studies; Why does a cost segregation study matter for property owners? And, • when certain issues identified in the cost segregation study need further examination. Web cost segregation studies are performed for federal income tax purposes; To help understand this tax strategy, below are answers to some commonly asked questions about cost segregation. Web a cost segregation study is a process that looks at each element of a property, splits them into different categories, and allows you to benefit from an accelerated depreciation timeline for some of those building components. Web cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land improvements, and qualified improvement property (qip) as well as identifying various expensing opportunities associated with. This guide provides important information about the principle elements of a cost segregation study and a cost segregation report, which we’ve summarized below.

Cost Segregation Study Template

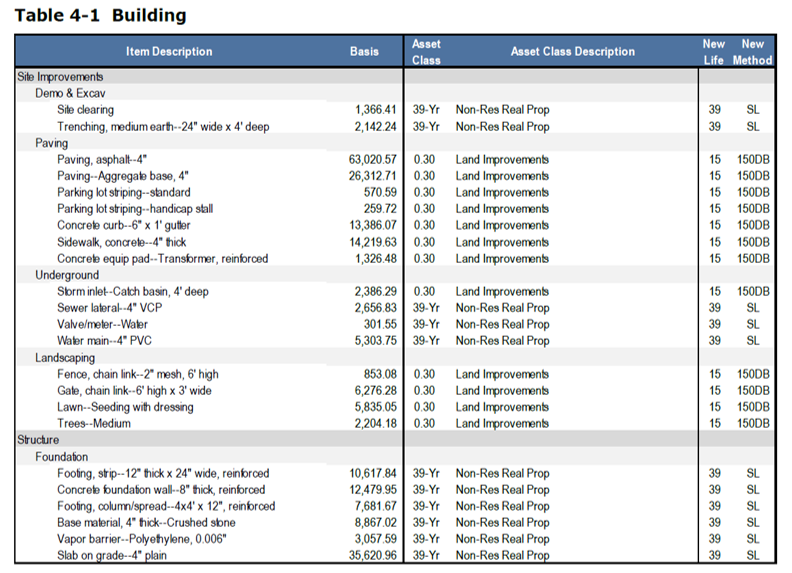

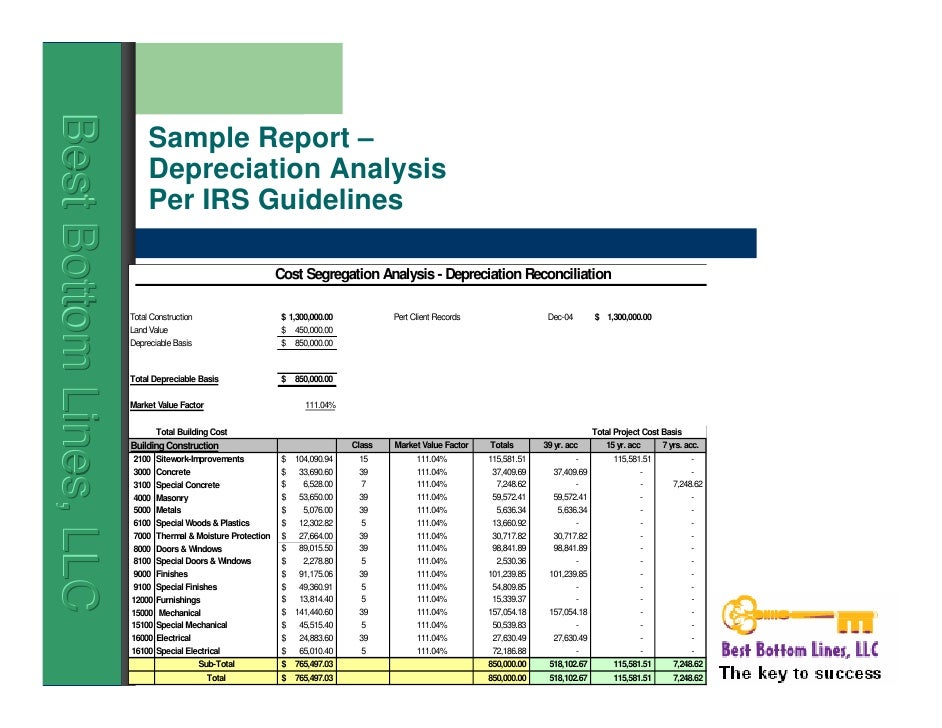

These approaches rely on construction and cost documentation, estimates, sampling, or a combination of these things to accurately perform a cost segregation study. Web to.

Cost Segregation Template

Web we will show the detail on applying a cost segregation study on property owned and placed in service prior to the current tax year..

Cost Segregation Study Template

Why does a cost segregation study matter for property owners? Web to understand how to do a cost segregation study yourself, look no further than.

Cost Segregation Excel Template

Web if you’re a property owner, a cost segregation study is an opportunity that can offer you significant tax savings. Web to understand how to.

Cost Segregation Excel Template

Web if your organization is expanding its footprint, constructing a new facility, or purchasing an existing one, a cost segregation study can help you accelerate.

Cost Segregation Study Template

• how cost segregation studies are prepared; Web cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land.

Cost Segregation Study Template

Web if you’re a property owner, a cost segregation study is an opportunity that can offer you significant tax savings. Web a cost segregation study.

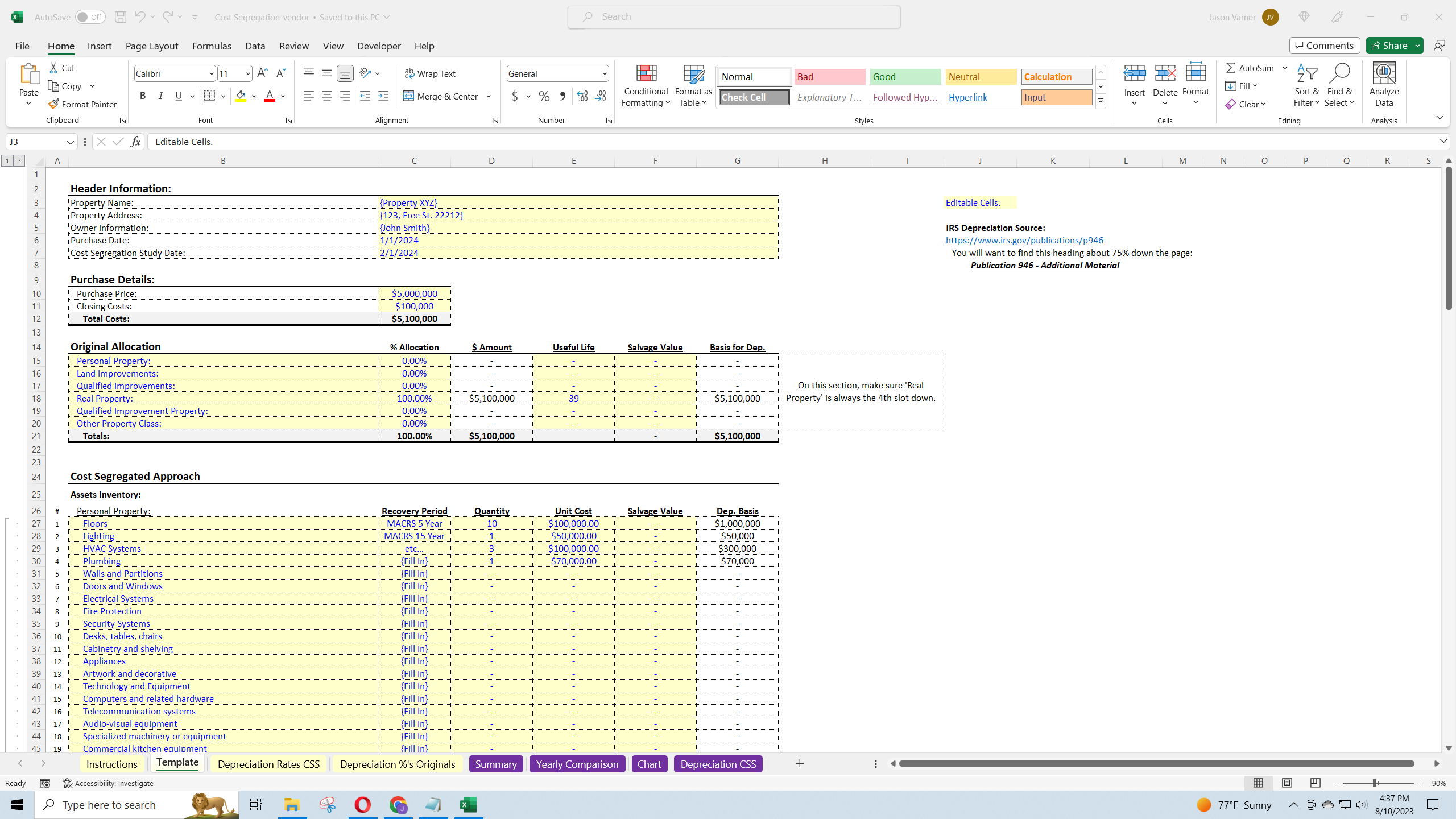

Excel Template Cost Segregation Study Multiple Property Class

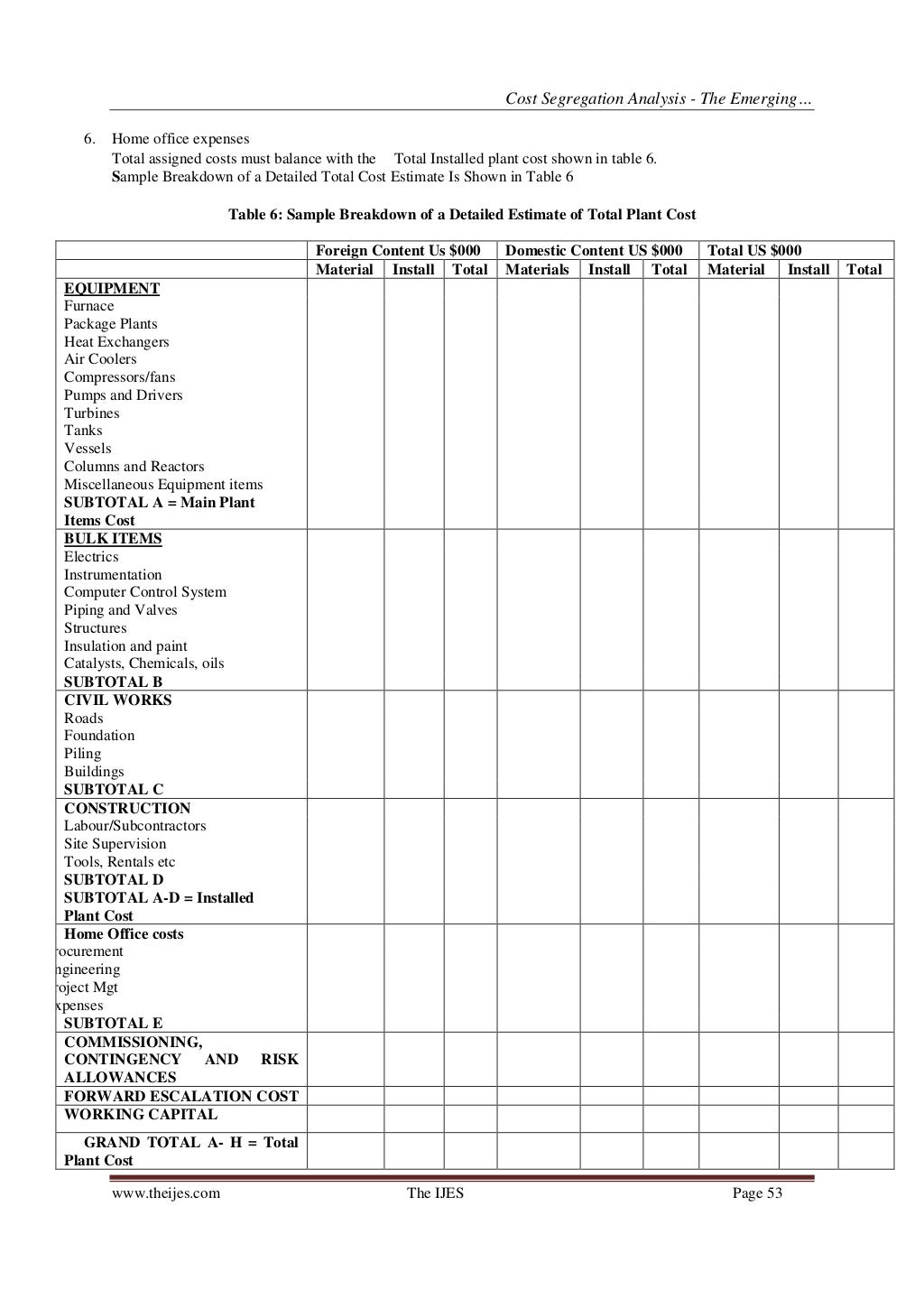

Web an approach (or methodology) to cost segregation is the method used to allocate total project costs to property assets. Web cost segregation studies are.

Cost Segregation Study Template

• how cost segregation studies are prepared; Web cost segregation studies are performed for federal income tax purposes; This guide provides important information about the.

And, • When Certain Issues Identified In The Cost Segregation Study Need Further Examination.

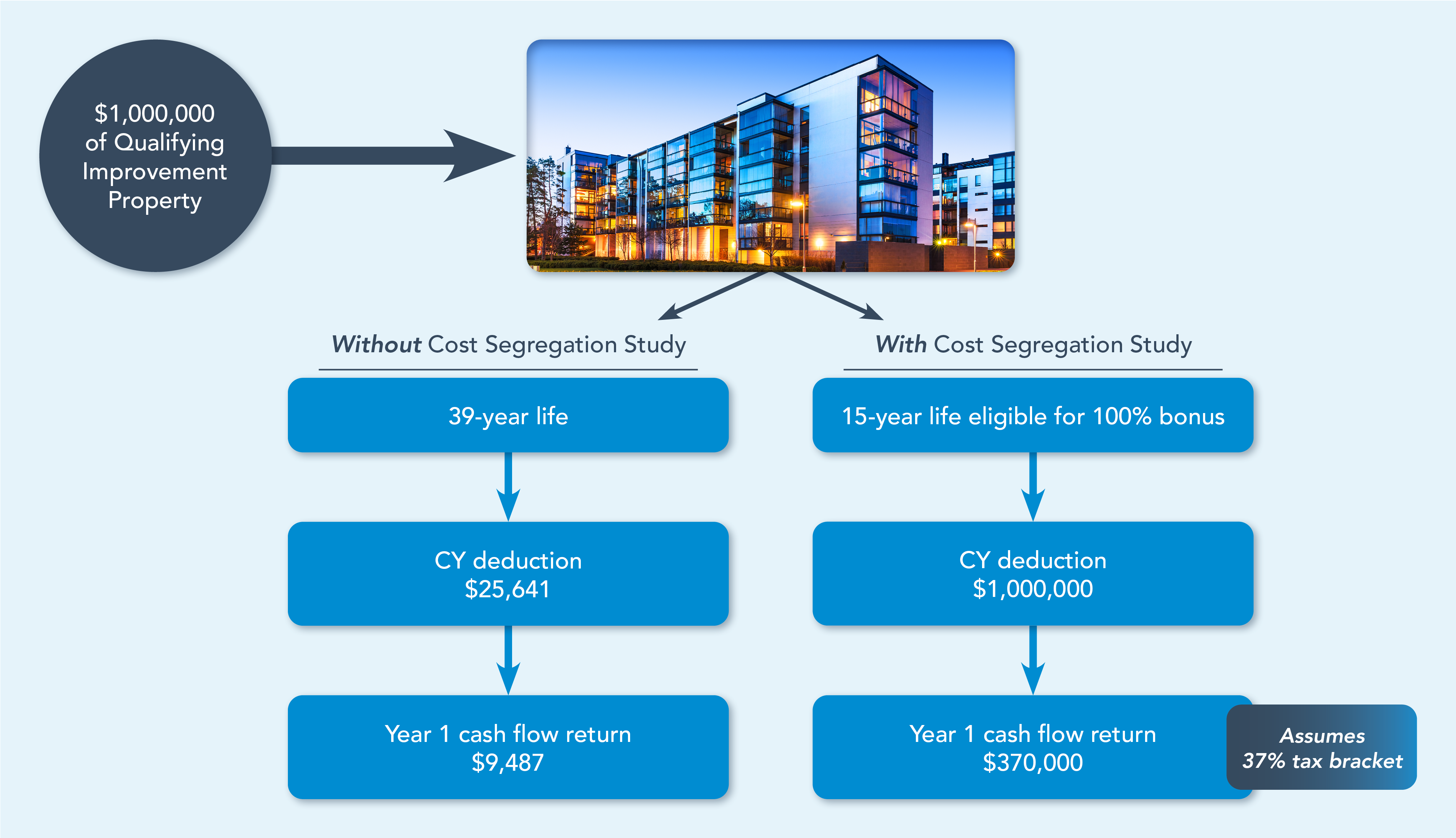

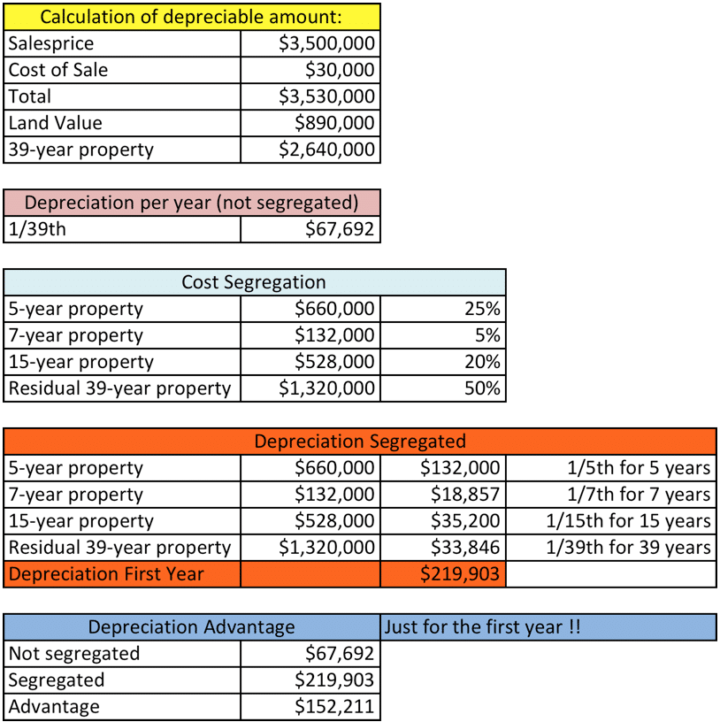

Web cost segregation is a tax planning strategy used by real estate investors that accelerates the depreciation deductions a taxpayer can claim for certain property assets. Why does a cost segregation study matter for property owners? Web a cost segregation study is a process that looks at each element of a property, splits them into different categories, and allows you to benefit from an accelerated depreciation timeline for some of those building components. Web we will show the detail on applying a cost segregation study on property owned and placed in service prior to the current tax year.

Web Cost Segregation Studies Free Up Capital By Accelerating The Depreciation Of § 1245 Tangible Personal Property, Land Improvements, And Qualified Improvement Property (Qip) As Well As Identifying Various Expensing Opportunities Associated With.

Web if you’re a property owner, a cost segregation study is an opportunity that can offer you significant tax savings. These approaches rely on construction and cost documentation, estimates, sampling, or a combination of these things to accurately perform a cost segregation study. Web cost segregation studies are performed for federal income tax purposes; To help understand this tax strategy, below are answers to some commonly asked questions about cost segregation.

• What To Look For In The Review And Examination Of These Studies;

• how cost segregation studies are prepared; Web an approach (or methodology) to cost segregation is the method used to allocate total project costs to property assets. Web if your organization is expanding its footprint, constructing a new facility, or purchasing an existing one, a cost segregation study can help you accelerate cash flow. Web to understand how to do a cost segregation study yourself, look no further than the irs cost segregation audit technique guide.