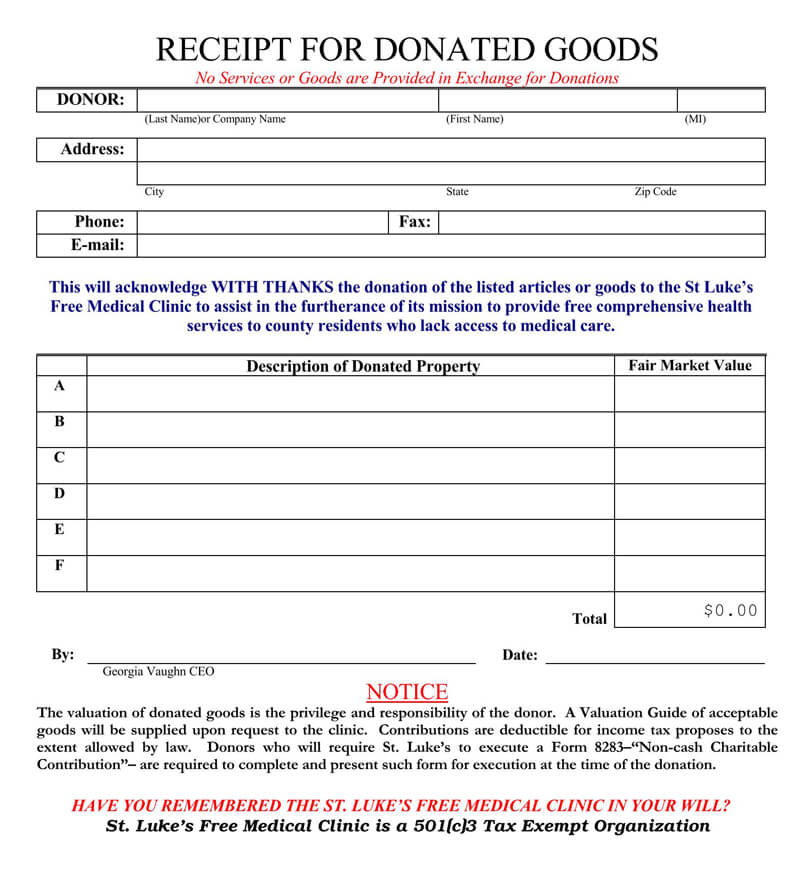

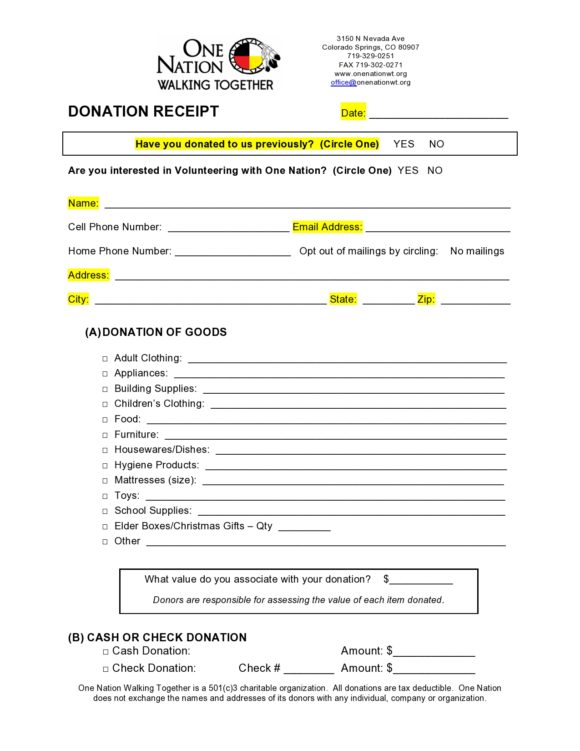

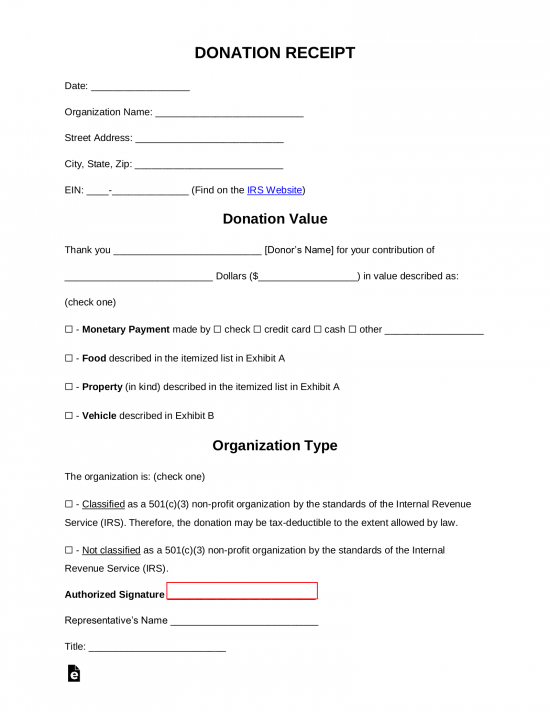

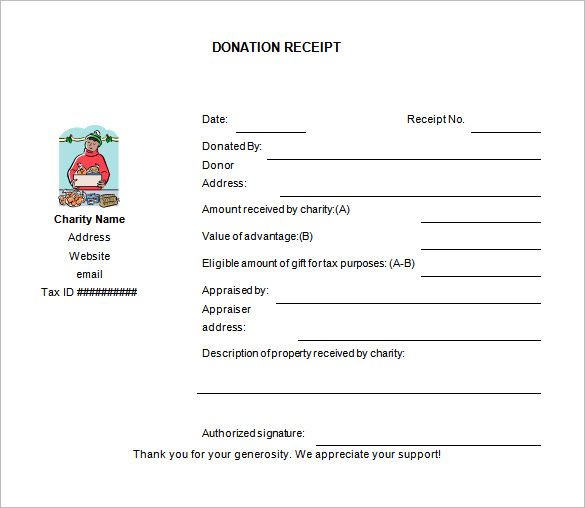

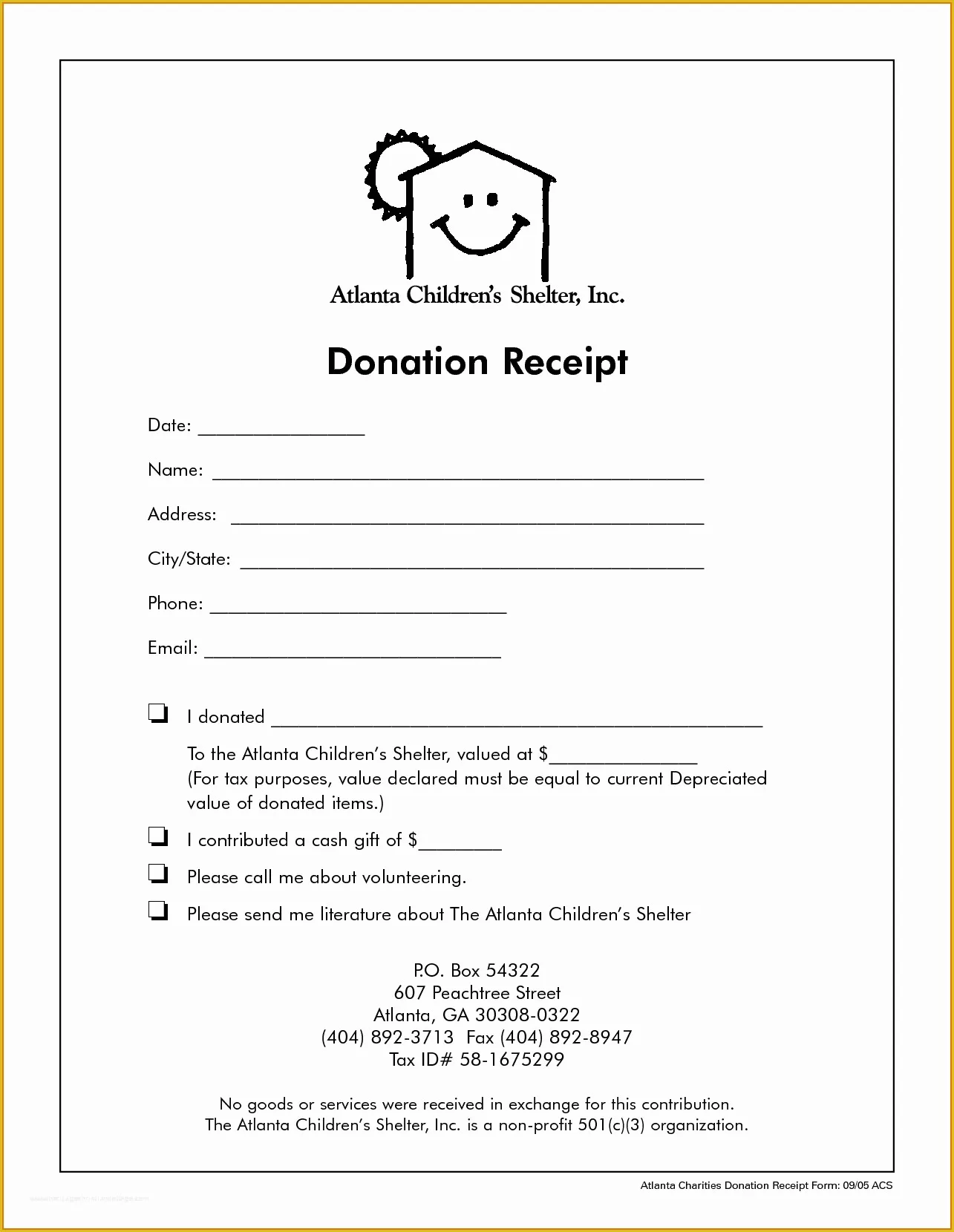

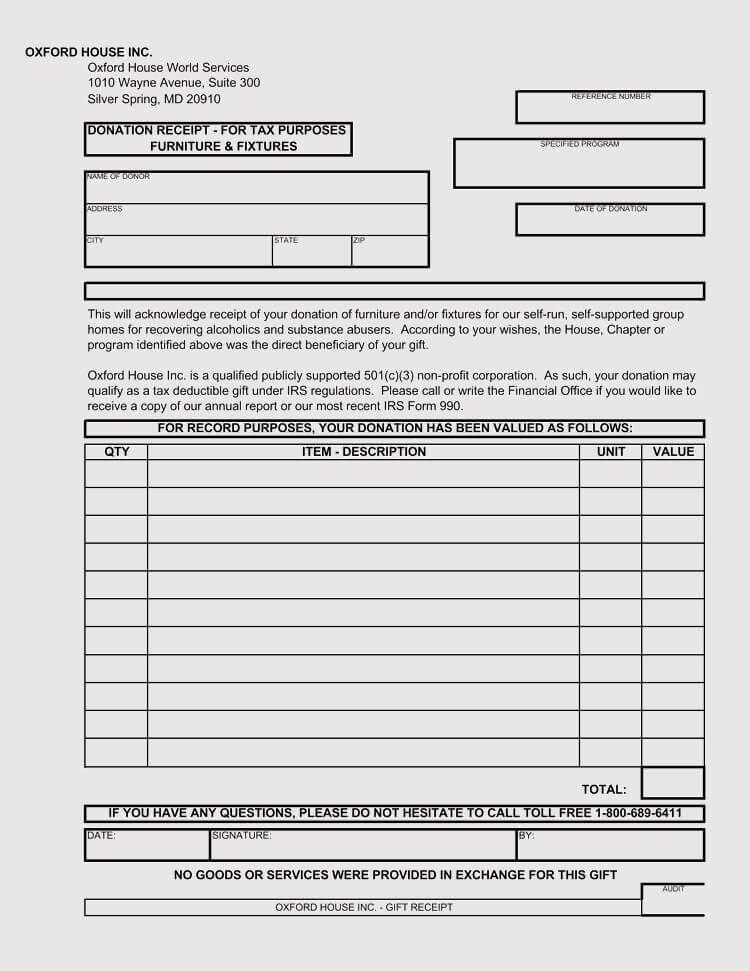

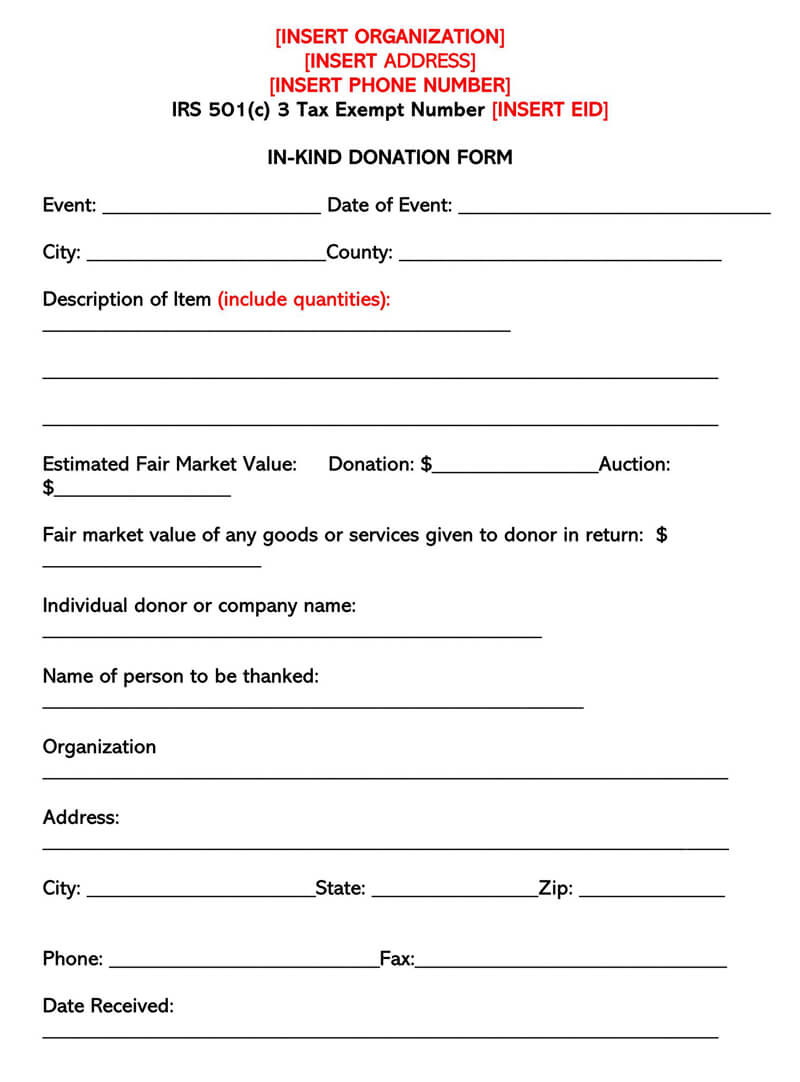

Not For Profit Donation Receipt Template - Web 501(c)(3) organization donation receipt. 40 donation receipt templates & letters [goodwill, non profit] may 24, 2017 11 mins read. Made to meet us & canada requirements. Web doing 5 reinforces trust with donors. These are given when a donor donates to a nonprofit organization. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. Web published july 5, 2023 • reading time: Web organizations that accept donations must have receipts. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Why do you need a donation receipt?

Free Printable Donation Receipt Template Printable Templates

Web doing 5 reinforces trust with donors. Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain.

Free Nonprofit (Donation) Receipt Templates (Forms)

There are many other reasons to send a receipt after receiving a donation. Web you can download one of our free templates or samples to.

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax.

Free Nonprofit (Donation) Receipt Templates (Forms)

Web in this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a.

8 Charitable Donation Receipt Template Template Guru

__________________ (find on the irs website) donor information. Explore these options to find the template that best suits your organization’s needs, and keep accurate records.

Free Donation Receipt Templates Samples PDF Word eForms

What does 501 (c) (3) mean? __________________ (find on the irs website) donor information. Explore these options to find the template that best suits your.

Nonprofit Receipt 6+ Examples, Format, Pdf

__________________ (find on the irs website) donor information. These are given when a donor donates to a nonprofit organization. There are many other reasons to.

Free Non Profit Donation Receipt Template Of 10 Donation Receipt

Web use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. A donation.

50+ FREE Donation Receipt Templates (Word PDF)

Web nonprofits must send a receipt for any single donation of $250 or more. Here’s what’s included in this article: This aids in financial management.

Web Organizations That Accept Donations Must Have Receipts.

40 donation receipt templates & letters [goodwill, non profit] may 24, 2017 11 mins read. Web charitable donation receipt templates provide a practical and efficient way to generate accurate receipts that acknowledge and record donations. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Explore these options to find the template that best suits your organization’s needs, and keep accurate records for tax purposes.

It’s Utilized By An Individual That Has Donated Cash Or Payment, Personal Property, Or A Vehicle And Seeking To Claim The Donation As A Tax Deduction.

Here’s what’s included in this article: Web choosing the right donation receipt template for your nonprofit not only ensures compliance with legal requirements but also helps build lasting relationships with your donors. Web 501(c)(3) organization donation receipt. Web you can download one of our free templates or samples to get a better idea of what a donation receipt should look like.

What To Include In A Donation Receipt.

When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs form 1023 to become a 501 (c) (3) nonprofit. There are many other reasons to send a receipt after receiving a donation. Web nonprofits must send a receipt for any single donation of $250 or more. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization.

Web This Donation Receipt Will Act As Official Proof Of The Contribution, And Help Donors Claim A Tax Deduction.

These are given when a donor donates to a nonprofit organization. Clear and consistent nonprofit donation receipts help build trust with your donors. This blog shares why donation receipts matter to donors and nonprofits, what to include, and how to customize and automate them to save time and raise more funds! This aids in financial management and reporting.

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)